The U.S. housing market has continued to cool, as rising mortgage rates and record-high sales prices have stifled affordability, weakening demand and pricing out a multitude of buyers. Nationally, median household income has failed to keep pace with increasing mortgage payments, with the costs of buying a home about 80% more expensive now than they were just three summers ago, according to the National Association of REALTORS® (NAR). As more and more prospective buyers find their home purchase plans delayed, many are turning to the rental market, where competition has intensified due to increased demand.

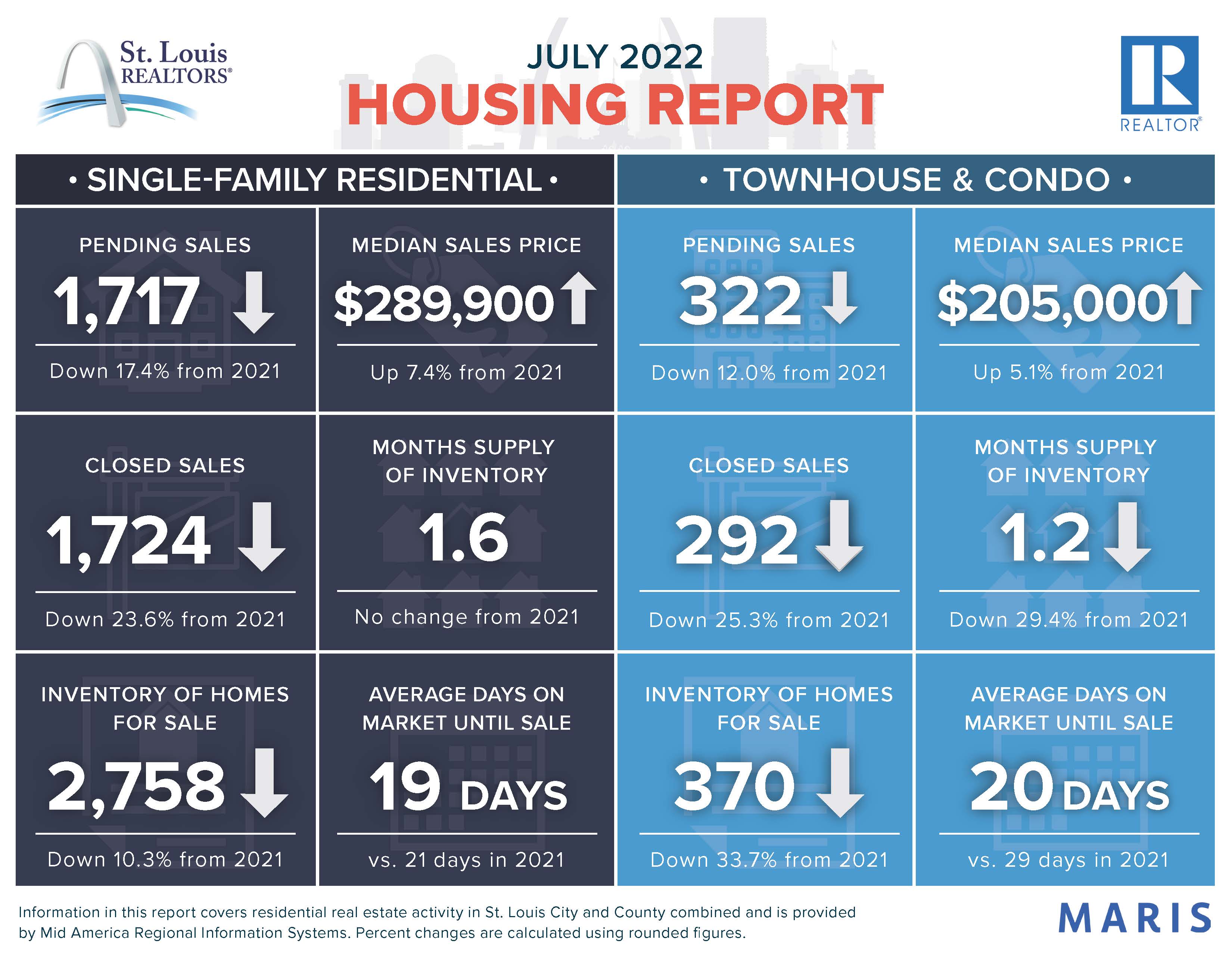

New listings decreased 13.6% for residential homes and 13.2% for townhouse/condo homes. Pending sales decreased 17.4% for residential homes and 12% for townhouse/condo homes. Inventory decreased 10.3% for residential homes and 33.7% for townhouse/condo homes.

Median sales price increased 7.4% to $289,900 for residential homes and 5.1% to $205,000 for townhouse/condo homes. Days on market decreased 9.5% for residential homes and 31% for townhouse/condo homes. Months supply of inventory remained flat for residential homes but decreased 29.4% for townhouse/condo properties.

At a time of year when homebuying activity is typically very strong, soaring homeownership costs have caused home sales to decline nationwide for the fifth consecutive month, with existing-home sales falling 5.4% month-to-month and 14.2% year-over-year as of the last measure, according to NAR. But there is a bright spot. Inventory of existing homes has continued to climb this summer, with 1.26 million homes available at the beginning of July, equivalent to a three months supply. And despite the summer slowdown, homes are still selling quickly, with the typical home staying on market for an average of 14 days.